How To Get The Best Mortgage Rate

Table of contents

Securing the best mortgage rate can significantly impact the total cost of your home, potentially saving you thousands over the loan’s life. Understanding the factors that affect mortgage rates and how to leverage them is crucial for Canadian homebuyers. Here’s a guide with practical tips to help you lock in the best mortgage rate in Canada.

Key Takeaways

- Lenders prefer consistent, reliable income to qualify for their best mortgage rates.

- High credit scores and a low debt-to-income ratio improve your eligibility.

- Monitoring market trends and comparing lenders can help secure the best rate.

Tips for Securing the Best Mortgage Rate in Canada

Understand and Improve Your Credit Score

A strong credit score is one of the most important factors in securing a lower mortgage rate. Lenders assess creditworthiness based on this score, which reflects your debt management history. Aim for 700 or higher by paying bills on time, keeping credit balances low, and avoiding unnecessary credit inquiries.

Save for a Larger Down Payment

A substantial downpayment reduces the loan amount and the lender’s risk, potentially leading to better mortgage terms. In Canada, a 20% downpayment or more can help avoid mortgage default insurance premiums, lowering overall borrowing costs.

Shop Around and Compare Lenders

Mortgage rates and terms vary across financial institutions, credit unions, and mortgage brokers. Comparing offers from multiple lenders can help secure the best rate for your situation. With nesto’s lowest-rate guarantee, if they can’t beat a competitor’s rate, they’ll give you $500, ensuring the best possible offer.

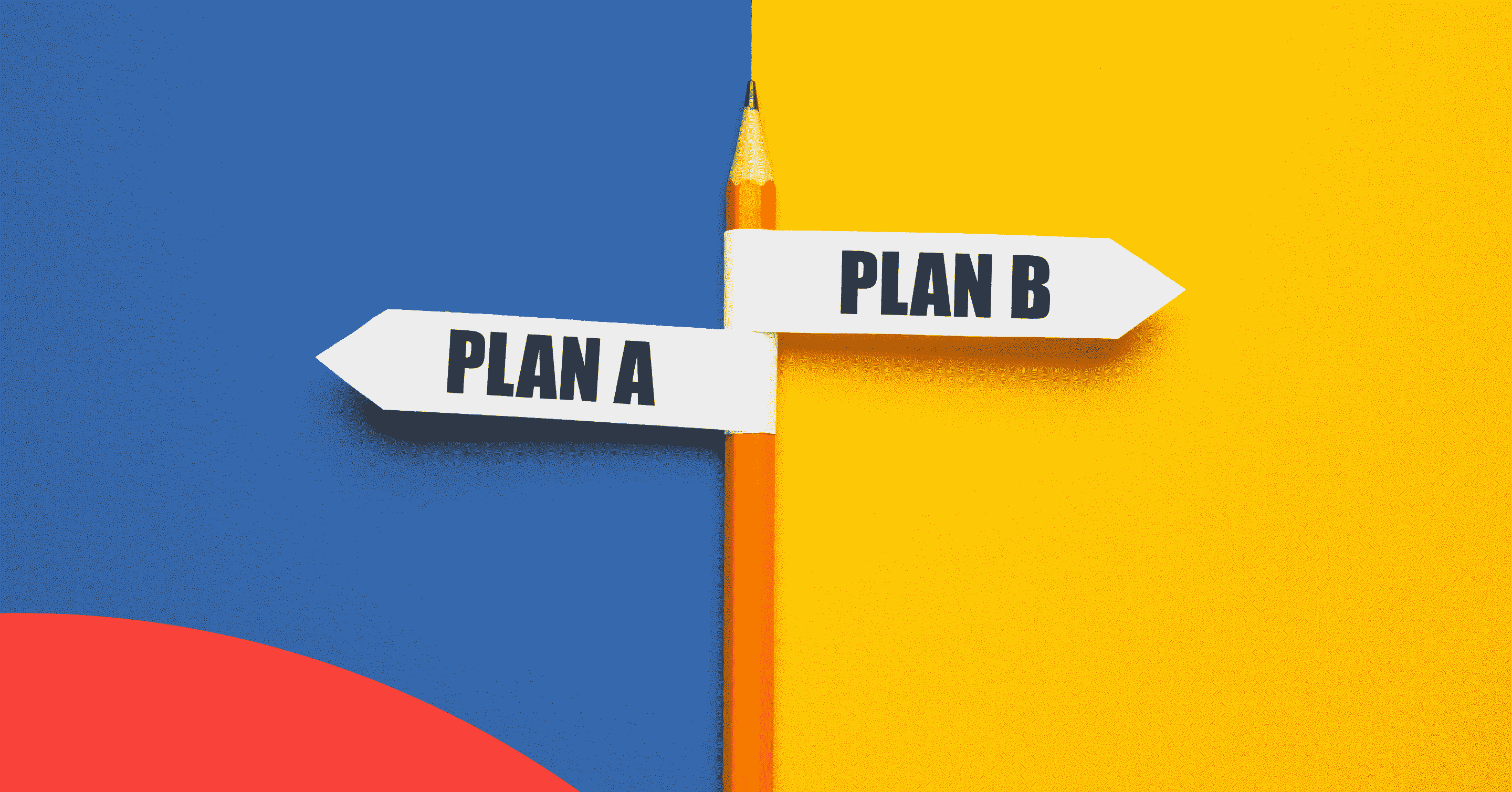

Consider Fixed vs. Variable Rates Based on Your Financial Goals

Fixed-rate and variable-rate mortgages each have benefits depending on market conditions and your financial situation. Fixed rates offer stability, while variable rates might start lower and fluctuate over time. Evaluate your financial stability and risk tolerance before deciding on the mortgage type.

Opt for a Shorter Amortization Period if Possible

While longer amortization periods may lower monthly payments, they increase the overall interest cost and often come with higher rates. Choosing a shorter amortization period reduces total interest paid and helps build home equity faster, lowering borrowing costs.

Maintain Stable Employment and Income History

Lenders look for borrowers with reliable employment, as this assures them of consistent income. A solid employment history, ideally in one field over three years, can positively impact your eligibility for favourable rates. If you’re self-employed, consider providing additional documentation to demonstrate income stability.

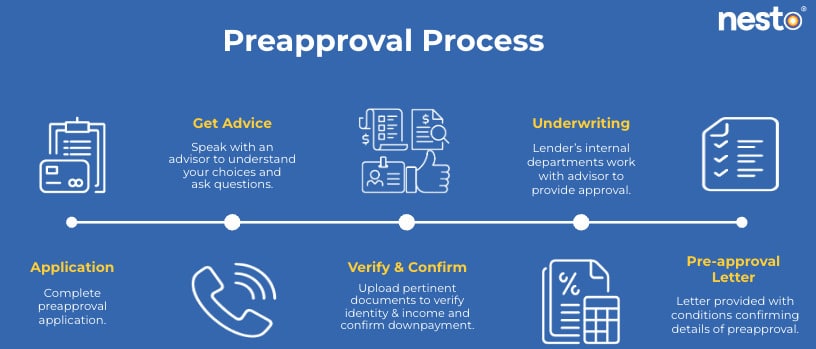

Get Pre-Approved for a Mortgage

A mortgage preapproval clarifies your borrowing power and locks in a rate for 90 to 120 days. Preapproval protects against potential rate increases, giving you peace of mind while you search for a home.

Alternatively, borrowers might consider a mortgage prequalification, a quick, informal assessment based on self-reported information like income and debts. Unlike preapproval, prequalification doesn’t commit borrowers to a rate and may be more flexible in a moderating rate environment.

Negotiate Terms and Conditions with Lenders

Don’t hesitate to negotiate for better rates or terms, especially if you have a strong credit profile and a substantial down payment. Some lenders may offer competitive rates for low-risk borrowers.

Consider All Associated Costs and Fees

Beyond the interest rate, mortgage costs include closing costs, appraisal, inspection, and legal fees, all of which affect affordability and borrowing costs. Understanding these additional costs will help avoid unexpected expenses.

Stay Informed About Market Trends and Mortgage Rate Forecasts

Economic conditions and Bank of Canada policies impact mortgage rates. Staying informed about rate trends can help time your application to secure a lower rate. Speak with mortgage experts or follow economic guidance to stay current.

Using a Mortgage Calculator to Assess Affordability

A mortgage payment calculator is a valuable tool for estimating monthly payments based on rates, terms, and expected mortgage amounts. Whether you’re a first-time homebuyer or renewing, use a calculator to explore scenarios and make informed decisions about your budget and mortgage options.

We’re curious…

Factors That Impact Mortgage Rates

| Why It Matters | How It Impacts Your Rate | |

|---|---|---|

| Credit Score | Indicates your history of managing debt. A high score shows financial responsibility and reliability to lenders. |

High Credit Score: Lowers your risk in the eyes of lenders, qualifying you for lower rates. Low Credit Score: This may result in higher rates as lenders view you as a higher-risk borrower and may require a strong co-borrower. |

| Employment & Income Stability | Demonstrates your ability to make payments consistently. Lenders want assurance of regular and predictable income for repayments. |

Stable Income: Increases chances of better rates, as lenders see you as a dependable borrower. Unstable Income: This may lead to higher rates or more strict requirements, such as adding a strong cosigner or guarantor to your application. |

| Down Payment Size | A larger downpayment reduces the loan amount, lowering lender risk. More equity signals financial stability. |

20%+ Down Payment: Avoids mortgage insurance while reducing monthly payments and interest-carrying costs. It may come with a slightly higher interest rate, but could save money if you don’t extend your amortization. Smaller Down Payment: This may require mortgage insurance, resulting in slightly higher monthly payments and carrying costs, even though it will come with slightly lower interest rates. |

| Market Conditions | Economic factors like inflation and Bank of Canada policies influence interest rates, making timing an essential aspect of your homebuying journey. |

Low-Rate Environment: Good timing can secure lower rates, but home prices are typically higher. High-Rate Environment: Rates may rise, but refinancing later could help if conditions improve – home prices are typically lower. |

Credit Score

Your credit score is a crucial indicator of how well you’ve managed debt in the past. Higher scores often qualify for lower mortgage rates, as they show lenders you’re financially responsible and likely to make timely payments. Lenders view high-score borrowers as low-risk, so they’re more willing to offer better rates. Conversely, a low credit score can indicate missed payments, making you a higher-risk borrower and resulting in a higher rate. Improving your score before applying can increase your chances of securing a lower interest rate.

Employment and Income Stability

Lenders closely examine your employment history and income stability to ensure you can meet monthly mortgage payments. Stable, predictable income reassures lenders of your financial capacity to make payments. Frequent job changes or fluctuating income can make lenders hesitant, suggesting a higher risk of missed payments. If you have a steady job and income, lenders view you as a safer investment, which can help you qualify for better rates. Self-employed applicants can strengthen their case by providing detailed financial documentation, like long-term or renewing contracts, to demonstrate income stability.

Down Payment Size

A larger downpayment reduces your loan amount, making you a lower risk to lenders. Putting down 20% or more lets you avoid mortgage default insurance, reducing extra monthly costs. A substantial downpayment also cushions lenders if the property’s value decreases, often resulting in better rates. Saving for a larger downpayment increases your borrowing power, improves loan terms, and lowers monthly payments.

Market Conditions

Mortgage rates are influenced by economic factors like inflation, employment rates, and Bank of Canada policies. When inflation or economic growth rises, rates typically follow as the Bank adjusts its policy to stabilize the economy. During downturns, rates may drop to encourage borrowing, allowing you to save with lower home prices. Staying informed about trends can help you time your mortgage application for the lowest interest and home prices. Working with a mortgage broker who monitors market fluctuations can give you an edge in securing the lowest rate.

High interest rates got you stressed?

Find your low rate refinance with nesto today

Frequently Asked Questions (FAQ) on Finding the Best Mortgage Rate in Canada

What is the best way to get a low mortgage rate in Canada?

To get a low mortgage rate, focus on a high credit score, a substantial down payment, and comparison shopping. A 700+ score signals financial reliability, while a 20% or larger downpayment lowers borrowing costs. Comparing rates from multiple lenders and monitoring rate trends also helps secure a competitive rate.

How does my credit score affect my mortgage rate in Canada?

Your credit score directly impacts your mortgage rate. Lenders consider a high score (700+) as a sign of responsibility, which may qualify you for lower rates. A lower score might lead to higher rates due to increased risk. Improving your score by paying bills on time and managing debt can make a significant difference when applying.

Does a bigger down payment reduce my mortgage rate in Canada?

Yes, a larger down payment can reduce your rate. With 20% or more, you avoid mortgage default insurance and reduce borrowing costs, signalling lower risk to lenders, potentially leading to better rates. Note, however, that the lowest rates are often reserved for insured mortgages with less than 20% down.

Is a fixed or variable mortgage rate better in Canada?

Choosing between a fixed or variable rate depends on your financial goals and comfort with rate changes. Fixed rates offer stable payments for predictability, while variable rates might start lower but fluctuate, possibly saving money if rates decrease. Reviewing both options with a mortgage expert can help decide based on your risk tolerance and financial plans.

What factors impact mortgage rates in Canada?

Factors like credit score, down payment size, employment stability, and market conditions affect mortgage rates in Canada. A high credit score, significant down payment, and stable job history often lead to lower rates. Following economic trends and mortgage rate forecasts can also help with timing your application.

Final Thoughts

Securing the best mortgage rate in Canada involves a strategic approach—understanding credit requirements, improving financial stability, staying updated on market trends, and comparing lender offers. Strengthening your credit, reducing debt, and maintaining stable income and employment improves your chances of locking in the best rate.

For a personalized mortgage strategy, contact a nesto mortgage expert to help navigate the mortgage process and find the best rate for your financial needs.

Why Choose nesto

At nesto, our commission-free mortgage experts, certified in multiple provinces, provide exceptional advice and service that exceeds industry standards. Our mortgage experts are non-commissioned, salaried employees who provide impartial guidance on mortgage options tailored to your needs and are evaluated based on client satisfaction and advice quality. nesto aims to transform the mortgage industry by providing honest advice and competitive rates using a 100% fully digital, transparent, seamless process.

nesto is on a mission to offer a positive, empowering and transparent property financing experience – simplified from start to finish.

Contact our licensed and knowledgeable mortgage experts to find your best mortgage rate in Canada.

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!